A strategic balance of flagship focus and innovative energy has streamlined Lagunitas’ lineup.

By: Courtney Iseman

Breweries across the country faced growing challenges in 2024. Consumer interest – and spending – continued to shift toward other categories, especially non-alcoholic beverages, while the cost of doing business kept rising. Against that backdrop, the success of Lagunitas Brewing Co. stands out. Founded in 1993, the brewery reached its highest share of the craft beer market since before the pandemic, climbing to 4.51%. Its two flagship beers also posted gains: Lagunitas IPA saw a 4.2% increase in sales, and A Little Sumpin’ Sumpin’ IPA grew by 4%.

What’s the brewery’s secret? Lagunitas has been recalibrating in recent years, closing a Chicago outpost to refocus on its original Petaluma, California, location and refreshing its leadership team between 2022 and 2024. In the midst of these shifts, the company identified key target areas crucial for growth.

“Last year, we took a hard look at our core market – not just the challenges craft is facing, especially with Gen Z, but also how we could simplify and sharpen our focus,” says Hannah Dray, who stepped into the Interim CMO role at Lagunitas in 2023. “That meant streamlining our core SKUs for stronger velocity and leaning into innovation where it matters most: high-ABV, flavor-forward brews, and non-alcoholic offerings.”

Streamlining has proven a promising path for breweries with longer histories like Lagunitas. In past years when craft beer still felt novel, curiosity drove consumer interest in anything new. Today’s consumer, meanwhile, is thirsty for the core staples they know and love, in search of alternative options like booze-free beverages, and still intrigued by a tighter curation of fresh, intentional releases. Lagunitas has translated this into renewed energy behind the flagships that made it famous alongside innovation in specific categories – and the marketing investment to support this all.

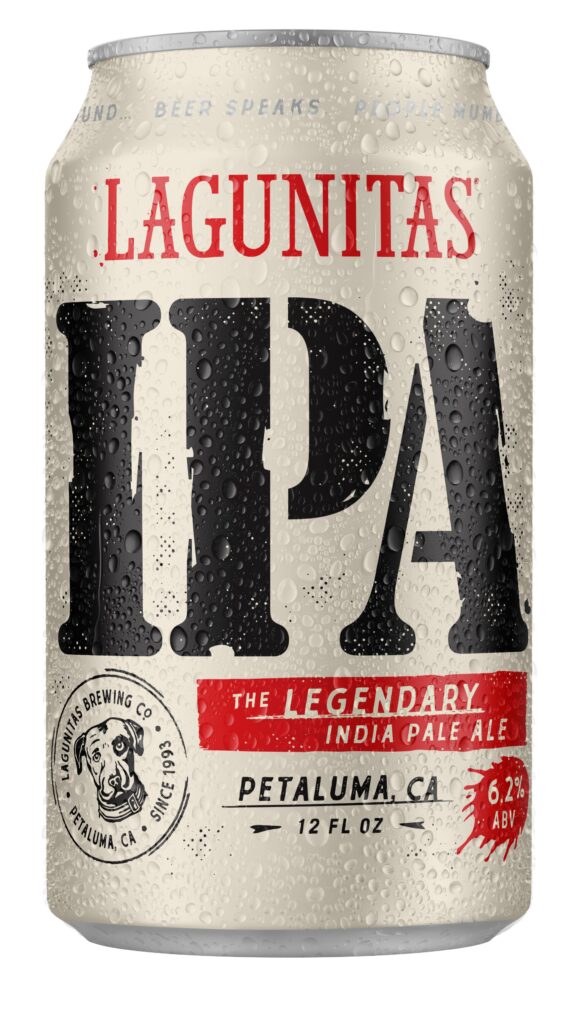

Lagunitas founder Tony Magee developed his IPA in 1995, putting the brewery on the map and helping define the boldly hoppy yet balanced American take on the style. A Little Sumpin’ Sumpin,’ or LSS, came along a decade later with a 50% wheat grain bill. Today, Lagunitas IPA remains the country’s best-selling draught IPA. LSS is the brewery’s #2 brand right behind IPA; together, they constituted 67% of Lagunitas’ 2024 sales to retailers. Lagunitas underwent a rebrand in 2022; in 2024, the brewery refreshed its look for IPA and LSS, simplifying packaging to emphasize what matters most – style, brand familiarity, that Petaluma origin, and a hint of nostalgia to the overall aesthetic.

“Over the years, Lagunitas has developed an eclectic range of packaging designs,” Dray says. “However, when considering memorable brands, it’s consistency and repetition that win the minds of consumers.” Maintaining consistency in what Dray calls Lagunitas’ “bold and unapologetic personality” has become core to the brewery’s branding. This involved including the brewery’s iconic dog mascot on IPA and reviving another favorite, the pinup-esque Millie, for LSS. These decisions “brought back recognizable assets,” Dray explains, “making it easier for shoppers to spot and connect with Lagunitas on shelves.”

Per Brewbound, Lagunitas allocated 60% of its investment in marketing to these flagships. But leadership has simultaneously placed an emphasis on their new rollouts.

“Returning to craft growth is about striking a balance,” Dray says. “[It’s] an ‘and’ over an ‘or’: It’s essential to reinvigorate the core while introducing strategic innovations that address the growth areas of the category and evolving consumer needs.”

In addition to claiming the top on-premise IPA, Lagunitas boasts the number three spot for IPA overall. They’re also third among non-alcoholic producers, and second for flavor-driven, high-ABV options. The channels where Lagunitas can successfully grow product development are clear.

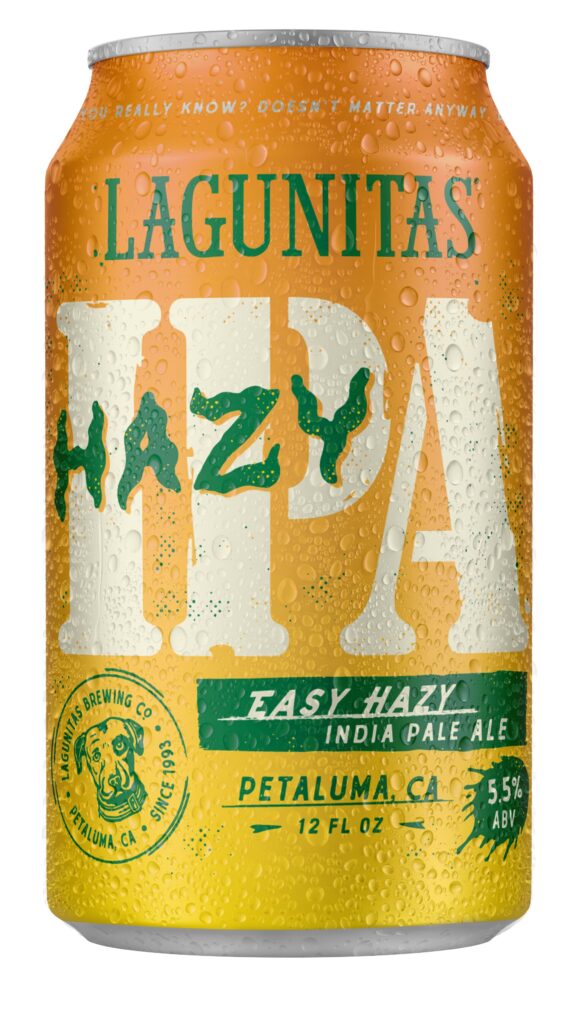

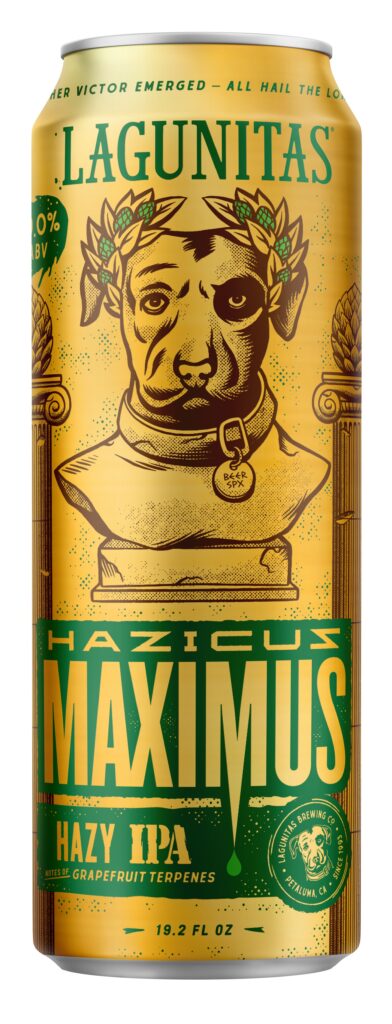

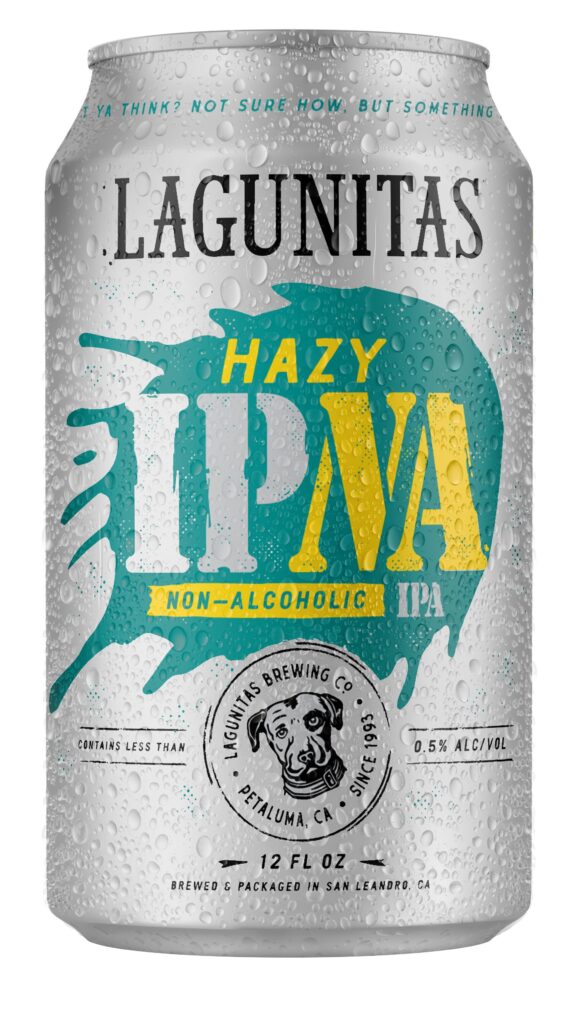

“Each innovation we’ve launched is grounded in what our consumers are telling us,” Dray says. That translates into the nationwide draught launch and off-premise California debut of Hazy IPA, a juicy, sessionable 5.5% ABV interpretation of the brewery’s penchant for boldly hoppy IPAs. To scratch that high-ABV itch, there’s Hazicus Maximus, a hazy IPA weighing in at 9%. Finally, Lagunitas has added a hazy IPA to its non-alcoholic team with the Hazy IPNA. This addition capitalizes on the brewery’s strong momentum in booze-free offerings.

“Hoppy Refresher remains the #1 hop water in the category, boasting the highest ROS and the widest distribution,” Dray says. “IPNA’s recent shift into cans has had a positive impact on the velocity rate. Hazy IPNA, launched at the beginning of 2025, is now the second best-selling non-alcoholic hazy IPA in a six-pack innovation.”

Even with doubling down on core products alongside such a focused approach to innovation and the growth that’s already catalyzed, Dray acknowledges challenges ahead.

“The craft market is facing some serious headwinds, and we’re not immune to the pressures of an increasingly competitive and evolving landscape,” she says. “That said, the strategy we set in motion continues to steer us in the right direction. Even with the bumps along the way, we’re gaining traction, building consistency, and seeing growing momentum with consumers.”

One crucial piece of the puzzle has been marketing the brewery’s streamlined yet fresh and relevant repertoire, speaking to longtime fans while reaching new audiences. Lagunitas has run a digital media campaign in its home state since March for IPA and Hazicus Maximus; nationally, they’ve made a concerted effort to be visible and available at music venues and events and have partnered with NPR’s popular Tiny Desk concert series.

“Increasing brand recognition has been a combination of refreshing our brand identity to have consistency at every touchpoint and bringing to life the brand personality, making the product more physically available across the nation, [and] organic and media supported digital amplification show up where our consumers are spending their time e.g. YouTube, Instagram, Reddit,” Dray says.

The plan moving forward is to “stay the course,” Dray adds, committing to their three pillars of core offerings, flavor-forward and high-ABV offerings, and non-alcoholic offerings, and doing so “in ways that are thoughtful, strategic, and impactful… and most importantly, true to the Lagunitas brand.”

Lagunitas’ Heavy-Hitter Lineup

CORE

IPA

A Little Sumpin’ Sumpin’

INNOVATION

Hazy IPA

About the Author: Courtney Iseman is a Brooklyn-based freelance writer covering craft beer and spirits for Food & Wine, Craft Beer & Brewing, Brewing Industry Guide, PUNCH, Inside Hook, VinePair, Thrillist, Wine Enthusiast, and more.